-

Builders FirstSource Reports Record First Quarter 2021 Results

来源: Nasdaq GlobeNewswire / 06 5月 2021 06:00:01 America/Chicago

Core Organic Sales Growth over 20%

Record Adjusted EBITDA & Adjusted EBITDA Margin

BMC Integration and Cost Savings Ahead of Plan

Acquired John’s Lumber, Premier Building Distributor Serving MichiganDALLAS, May 06, 2021 (GLOBE NEWSWIRE) -- Builders FirstSource, Inc. (Nasdaq: BLDR) today reported its results for the first quarter ended March 31, 2021. In January 2021, the Company closed the BMC all-stock merger creating the nation’s premier supplier of building materials and services.

First Quarter 2021 BFS Highlights (includes BMC in Q1 2021 and not in Q1 2020)

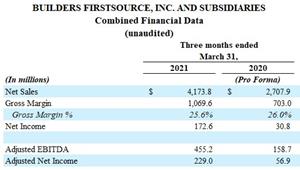

All Year-Over-Year Comparisons Unless Otherwise Noted:- Net sales of $4.2 billion for the quarter increased 133.6% driven by the merger with BMC, commodity inflation, and strong organic growth

- Gross profit of $1.1 billion increased 129.8% driven by the merger with BMC, commodity inflation, and strong organic growth

- Net income of $172.6 million, or $0.83 per diluted share, and adjusted net income of $229.0 million, or $1.10 per diluted share

First Quarter 2021 Highlights Compared to Combined Non-GAAP Pro Forma First Quarter 2020

- Net sales of $4.2 billion for the quarter increased 54.1% compared to the combined pro forma prior year period

- Core organic sales increased 22.0%, excluding commodity and acquisition impacts

- Commodity inflation increased net sales 31.3%

- Acquisitions contributed to net sales growth of 2.4%

- Gross profit of $1.1 billion increased 52.1% compared to the combined pro forma prior year period

- As a percentage of net sales, SG&A decreased 270 basis points to 19.7%

- Net income of $172.6 million, or $0.83 per diluted share, and adjusted net income of $229.0 million, or $1.10 per diluted share

- Adjusted EBITDA increased 186.8% to $455.2 million, driven by strong demand in the residential housing market, commodity value, and disciplined cost management

- Adjusted EBITDA margin increased 500 basis points to 10.9%

- Strong quarter-end balance sheet with a net debt to LTM Adjusted EBITDA ratio of 1.2x and liquidity of $1.1 billion

Dave Flitman, CEO of Builders FirstSource, commented, “The positive momentum in our business continued with record first quarter results. We are working closely with our customers to reduce cycle times amid material availability constraints and capitalize on strong underlying demand in the single family residential housing market.” Flitman continued, “I very much appreciate the efforts of our more than 26,000 team members who are working tirelessly to provide best-in-class service for our customers in these unprecedented market conditions. We also look forward to welcoming the associates of John’s Lumber to the BFS team.”

Flitman stated, “Our integration efforts are ahead of plan and we remain confident in achieving the cost synergies related to our merger with BMC. The combined teams are working well together and through strong execution delivered record Adjusted EBITDA of $455.2 million, an increase of 187%, and record Adjusted EBITDA margin of nearly 11%. This performance was enabled by our tremendous core organic sales growth of 22%. Our very strong balance sheet underpins our strategic growth focus through reinvestment in the business and M&A, while delivering enhanced value to our stakeholders. We are continuing to build our world-class homebuilding distribution platform that positions us as a partner of choice.”

CFO Peter Jackson added, “The early returns on our recently completed transaction with BMC are reflected in our exceptional first quarter results. We experienced stronger-than-expected demand in single family starts across the country, and we are well positioned to support this sustained demand. We are responding effectively to rapidly evolving market dynamics to help our customers meet the surging demand for housing. As we move forward, we are well prepared to take advantage of favorable market conditions by utilizing our industry-leading scale, product portfolio, and cash generation."

Builders FirstSource Financial Performance Highlights - First Quarter 2021 Compared to a Combined Non-GAAP Pro Forma First Quarter 2020

Pro Forma Net Sales

- Net sales for the first quarter ending March 31, 2021 were $4.2 billion, a 54.1% increase compared to a combined pro forma year ago. Core organic sales, which excludes acquisitions, commodity price fluctuations and differences in selling days between periods, increased by 22.0% while commodity price inflation added 31.3% to net sales.

- Value-added core organic sales grew by an estimated 22.1%, led by 41.5% growth in our Manufactured Products category. Robust demand nationally was somewhat hindered by material availability constraints.

- Demand improved in single family starts during the quarter. Single family, repair and remodel / other grew estimated combined core organic sales by 29.6% and 5.4% respectively, while multi- family declined 3.1%.

- Acquisitions, excluding the BMC merger, completed during the prior four quarters contributed net sales growth of 2.4%.

Gross Profit

- Gross profit was $1.1 billion, an increase of $366.6 million or 52.1% compared with the combined pro forma prior year period. Our gross margin decreased 40 basis points to 25.6%, primarily due to a one-time purchase accounting adjustment.

Selling, General and Administrative Expenses

- SG&A was $821.6 million, an increase of approximately $214.4 million or 35.3% compared to the combined pro forma prior year period, driven primarily by the effects of purchase accounting for the BMC Merger, including $83.2 million of amortization expense of acquired intangibles, one-time charges, as well as higher variable compensation related to the increase in profitability and acquisitions. Excluding these variables, underlying SG&A decreased by 2.6%. As a percentage of net sales, SG&A decreased by 270 basis points to 19.7% due to the effect of higher net sales and continued expense control.

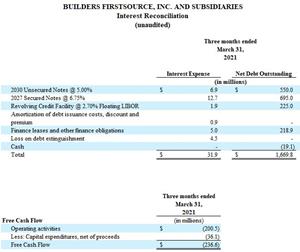

Interest Expense

- Interest expense decreased by $25.4 million to $31.8 million compared to the same combined pro forma period last year. The year over year decrease includes higher one-time charges of $28.0 million related to debt financing transactions during the first quarter of 2020, compared to $4.5 million in the first quarter of 2021.

Income Tax Expense

- Driven by higher profitability, income tax expense in the first quarter of 2021 was $43.5 million, compared to $7.7 million in the combined proforma prior year period. The effective tax rate in the first quarter of 2021 was 20.1%, slightly lower than the estimated annual effective tax rate driven primarily by the periodic impact of stock-based compensation adjustments during the quarter.

Net Income

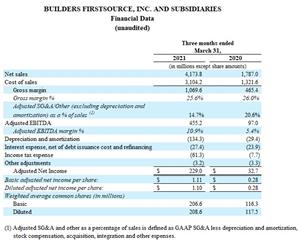

- GAAP net income was $172.6 million, or $0.83 earnings per diluted share, compared to a combined pro forma $30.8 million, or $0.15 earnings per diluted share, in the same period a year ago. Adjusted net income was $229.0 million, or $1.10 earnings per diluted share, compared to a combined pro forma $56.9 million, or $0.28 earnings per diluted share, in the first quarter of 2020. The 302.5% increase in adjusted net income was primarily driven by the increase in net sales described above and improved overhead leverage offset by higher tax expense.

Adjusted EBITDA

- Adjusted EBITDA increased 186.8% to $455.2 million, driven by solid demand across single family and repair and remodel/other customer end markets, commodity inflation and cost leverage.

- Adjusted EBITDA margin improved to a record 10.9%, which increased 500 basis points compared to 5.9% in the same combined pro forma period a year ago.

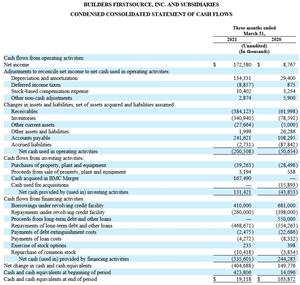

Builders FirstSource Capital Structure, Leverage, and Liquidity Information

- Cash used in operating activities was $200.5 million for the first quarter. Cash provided by investing activities was $131.4 million for the first quarter, including capital expenditures, net of proceeds, of $36.1 million. The Company’s free cash was an outflow of $237 million in the quarter, primarily based on the impact of commodity inflation on our working capital. The Company expects to build its free cash flow during the year.

- Liquidity as of March 31, 2021 was $1.1 billion, consisting of over $1 billion in net borrowing availability under the revolving credit facility and $19 million cash on hand.

- Adjusted EBITDA, on a combined pro forma trailing twelve-month basis, was $1.4 billion and net debt was $1.7 billion as of March 31, 2021. Our net leverage ratio declined to 1.2x.

Pro Forma Combined Unaudited and Adjusted Information, First Quarter 2021

The Company has provided supplemental unaudited financial data of the combined company in this press release. The below financial data combines Builders FirstSource and BMC historical operating results as if the businesses had been operated together on a combined basis during prior periods along with adjustments to reclassify certain BMC historical financial information to conform to Builders FirstSource historical financial information. This financial data is not intended to be, and was not, prepared on a basis consistent with the unaudited pro forma condensed combined financial information included in Builders FirstSource’s Pre-effective amendment to an S-4 filing dated November 17, 2020 with the U.S. Securities and Exchange Commission (the “Pro Forma S-4 Filing”), which provides the pro forma data information prepared in accordance with Article 11 of SEC Regulation S-X.

BMC Merger Integration

Operating in most of the nation's largest and fastest growing regions, the combined company is exceptionally positioned for long-term value creation. Since closing the merger with BMC on January 1, 2021, Builders FirstSource has made substantial progress in integrating the two companies while delivering solid execution.

The Company’s increased scale, a strong balance sheet bolstered by robust cash generation, and anticipated annual run-rate synergies of $130 million to $150 million by the end 2023 are expected to provide greater resources to invest in growth, innovation and ongoing value creation for all stakeholders.

M&A Update

On May 3, 2021, BFS completed the acquisition of John’s Lumber, a premier building materials supplier serving the largest housing markets in Michigan. The acquisition adds another top 50 Metropolitan Statistical Area (MSA) to the Company’s portfolio and provides enhanced scale that will benefit our existing 14 locations in the state. John’s Lumber products include framing lumber and sheet goods, windows, doors, molding and trim, siding, decking, kitchen and bath, and installation services. The company generated approximately $49 million in total net sales for the trailing twelve months ended March 31, 2021.

2021 OutlookFor 2021, the Company expects significant improvement in its financial performance, including the following:

- Net sales to grow to a range of $16.0 billion to $17.0 billion or approximately 25% to 33% over 2020 combined pro forma net sales of $12.8 billion.

- Adjusted EBITDA to be in a range of $1.75 billion to $1.85 billion or approximately 64% to 73% over 2020 combined pro forma Adjusted EBITDA of $1.07 billion.

- Expected realized cost savings of $60 million to $70 million

- Free cash flow in the range of $1.3 billion to $1.5 billion

The 2021 outlook is based on several assumptions, including the following:

- Single family starts percentage growth across our geographies in the low double digits; multi-family starts percentage decline in the high single to low double digits; and R&R growth in the low to mid-single digits.

- Commodity price appreciation of 10% to 20% compared to the prior year

- Recently completed acquisitions net sales growth of 2%

- 2 fewer selling day in 2021 versus 2020 or approximately 1%

- Depreciation and amortization expenses in the range of $540 million to $550 million, including approximately $325 million of amortization related to intangible assets acquired in the BMC Merger.

- Capital Expenditures in the 1.4% to 1.6% range of net sales

- Interest expense in the range of $110 million to $115 million

- An effective tax rate of between 23.0% to 25.0%

Conference Call

Builders FirstSource will host a conference call Thursday, May 6, 2021, at 8:00 a.m. Central Time (CT) and will simultaneously broadcast it live on the Internet. The earnings release presentation will be posted at www.bldr.com under the “investors” section before the market opens on Thursday May 6th. To participate in the teleconference, please dial into the call a few minutes before the start time: 800-700-1722 (U.S. and Canada) and 334-323-0501 (international), Conference ID: 2715970. A replay of the call will be available at 12 noon Central Time through May 21, 2021. To access the replay, please dial 888-203-1112 (U.S. and Canada) and 719-457-0820 (international) and refer to pass code 2715970. The live webcast and archived replay can also be accessed on the Company's website at www.bldr.com under the “Investors” section. The online archive of the webcast will be available for approximately 90 days.About Builders FirstSource

Headquartered in Dallas, Texas, Builders FirstSource is the largest U.S. supplier of building products, prefabricated components, and value-added services to the professional market segment for new residential construction and repair and remodeling. We provide customers an integrated homebuilding solution, offering manufacturing, supply, delivery and installation of a full range of structural and related building products. We operate in 40 states with approximately 550 locations and have a market presence in 47 of the top 50 and 86 of the top 100 MSA’s, providing geographic diversity and balanced end market exposure. We service customers from strategically located distribution and manufacturing facilities (certain of which are co-located) that produce value-added products such as roof and floor trusses, wall panels, stairs, vinyl windows, custom millwork and pre-hung doors. Builders FirstSource also distributes dimensional lumber and lumber sheet goods, millwork, windows, interior and exterior doors, and other building products. For more information about Builders FirstSource, visit the Company’s website at www.bldr.com.Forward-Looking Statements

Statements in this news release and the schedules hereto that are not purely historical facts or that necessarily depend upon future events, including statements about expected market share gains, forecasted financial performance or other statements about anticipations, beliefs, expectations, hopes, synergies, intentions or strategies for the future, may be forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. Readers are cautioned not to place undue reliance on forward-looking statements. In addition, oral statements made by our directors, officers and employees to the investor and analyst communities, media representatives and others, depending upon their nature, may also constitute forward-looking statements. As with the forward-looking statements included in this release, these forward-looking statements are by nature inherently uncertain, and actual results may differ materially as a result of many factors. All forward-looking statements are based upon information available to Builders FirstSource, Inc. on the date this release was submitted. Builders FirstSource, Inc. undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Any forward-looking statements involve risks and uncertainties that could cause actual events or results to differ materially from the events or results described in the forward-looking statements, including risks or uncertainties related to the recent novel coronavirus disease 2019 (also known as “COVID-19”) pandemic, the Company’s growth strategies, including gaining market share, or the Company’s revenues and operating results being highly dependent on, among other things, the homebuilding industry, lumber prices and the economy. Builders FirstSource, Inc. may not succeed in addressing these and other risks. Further information regarding factors that could affect our financial and other results can be found in the risk factors section of Builders FirstSource, Inc.’s most recent annual report on Form 10-K filed with the Securities and Exchange Commission. Consequently, all forward-looking statements in this release are qualified by the factors, risks and uncertainties contained therein.Non-GAAP Financial Measures

The financial measures entitled Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income, diluted Adjusted net income per share and Free cash flow are not financial measures recognized under GAAP and are therefore non-GAAP financial measures. The Company believes that these non-GAAP financial measures provide useful information to management and investors regarding certain financial and business trends relating to the Company’s financial condition and operating results.

Adjusted EBITDA is defined as GAAP net income before depreciation and amortization expense, interest expense, net, income tax expense and other non-cash or special items including stock compensation expense, acquisition and integration expense, debt issuance and refinancing costs, gains (loss) on sale and asset impairments and other items. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by net sales. Adjusted net income is defined as GAAP net income before non-cash or special items including acquisition and integration expense and debt issuance and refinancing cost offset by the tax effect of those adjustments to net income. Adjusted net income per diluted share is defined as Adjusted net income divided by weighted average diluted common shares outstanding. Free cash flow is defined as GAAP net cash from operating activities less capital expenditures, net of proceeds from the sale of property, plant and equipment.

Company management uses Adjusted EBITDA, Adjusted EBITDA margin and Adjusted net income as supplemental measures in its evaluation of the Company’s business, including for trend analysis, purposes of determining management incentive compensation and budgeting and planning purposes. Company management believes that these measures provide a meaningful measure of the Company’s performance and a better baseline for comparing financial performance across periods because these measures eliminate the effects of period to period changes, in the case of Adjusted EBITDA and Adjusted EBITDA margin, in taxes, costs associated with capital investments, interest expense, stock compensation expense, and other non-cash and non-recurring items and, in the case of Adjusted net income, in certain non-recurring items. Company management also uses free cash flow as a supplemental measure in its evaluation of the Company’s business, including for purposes of its internal liquidity assessments. Company management believes that free cash flow provides a meaningful evaluation of the Company’s liquidity.

The Company believes that these non-GAAP financial measures provide additional tools for investors to use in evaluating ongoing operating results, cash flows and trends and in comparing the Company’s financial measures with other companies in the Company’s industry, which may present similar non-GAAP financial measures to investors. However, the Company’s calculation of these financial measures are not necessarily comparable to similarly titled measures reported by other companies. Company management does not consider these financial measures in isolation or as alternatives to financial measures determined in accordance with GAAP. Furthermore, items that are excluded and other adjustments and assumptions that are made in calculating these non-GAAP financial measures are significant components in understanding and assessing the Company’s financial performance. These non-GAAP financial measures should be evaluated in conjunction with, and are not a substitute for, the Company’s GAAP financial measures. Further, because these non-GAAP financial measures are not determined in accordance with GAAP and are thus susceptible to varying calculations, the non-GAAP financial measures, as presented, may not be comparable to other similarly titled measures of other companies. Reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the tables below.

The Company’s Adjusted EBITDA outlook and full-year forecast for its effective tax rate on operations exclude the impact of certain income and expense items that management believes are not part of underlying operations. These items may include, but are not limited to, loss on early extinguishment of debt, restructuring charges, certain tax items, and charges associated with non-recurring professional and legal fees associated with acquisitions. The Company’s management cannot estimate on a forward-looking basis without unreasonable effort the impact these income and expense items will have on its reported Net income and its reported effective tax rate because these items, which could be significant, are difficult to predict and may be highly variable. As a result, the Company does not provide a reconciliation to the most comparable GAAP financial measure for its Adjusted EBITDA outlook or its effective tax rate on operations forecast. Please see the Forward-Looking Statements section of this release for a discussion of certain risks relevant to the Company’s outlook.

Pro Forma Combined Financial Data

For avoidance of doubt, the Pro Forma Combined Unaudited and Adjusted Information also was not intended to be, and was not, prepared on a basis consistent with the unaudited pro forma condensed combined financial information included in Builders FirstSource’s Pre-effective amendment to an S-4 filing dated November 17, 2020 with the U.S. Securities and Exchange Commission (the “Pro Forma S-4 Filing”), which provides the pro forma financial information prepared in accordance with Article 11 of SEC Regulation S-X. For instance, the Supplemental Unaudited Combined Financial Information does not give effect to the BMC merger under the acquisition method of accounting in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 805, Business Combinations (“ASC Topic 805”), with Builders FirstSource treated as the legal and accounting acquirer, and was not prepared to reflect the merger as if it occurred on the first day of any of the fiscal periods presented. The Pro Forma Combined Unaudited and Adjusted Information has not been adjusted to give effect to pro forma events that are (1) directly attributable to the merger, (2) factually supportable, or (3) expected to have a continuing impact on the combined results of Builders FirstSource and BMC. Consequently, the Pro Forma Combined Unaudited and Adjusted Information is intentionally different from, but does not supersede, the pro forma financial information set forth in the Pro Forma S-4 Filing or the proforma financial information set forth in the Company’s most recent quarterly report on Form 10-Q.

In addition, the Pro Forma Combined Unaudited and Adjusted Information does not purport to indicate the results that actually would have been obtained had the companies been operated together during the periods presented, or which may be realized in the future. The Pro Forma Combined Unaudited and Adjusted Information have no impact on Builders FirstSource’s or BMC’s previously reported consolidated balance sheets or statements of operations, cash flows or equity.

Contact:

Michael Neese

SVP, Investor Relations

Builders FirstSource, Inc.

(214) 765-3804Tables accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/fd8d170a-f3fc-423c-ba3a-527fb41d7fd0

https://www.globenewswire.com/NewsRoom/AttachmentNg/fc0bc2c3-a07a-4a66-883c-5259381a7ddf

https://www.globenewswire.com/NewsRoom/AttachmentNg/3f32caf8-3428-48bf-a260-bc8e5a79888a

https://www.globenewswire.com/NewsRoom/AttachmentNg/d7bf2c68-23ac-47ea-8669-41a0528d4da9

https://www.globenewswire.com/NewsRoom/AttachmentNg/91c378ea-3498-4b2b-8a36-2f425beba904

https://www.globenewswire.com/NewsRoom/AttachmentNg/9effea75-6752-4095-9e91-075d0912dd24

https://www.globenewswire.com/NewsRoom/AttachmentNg/f11c6e58-37f1-457d-b334-4f4ee306e5af

https://www.globenewswire.com/NewsRoom/AttachmentNg/66a12732-18b2-4223-a401-cb8703038eff

https://www.globenewswire.com/NewsRoom/AttachmentNg/54827eb0-68c9-4a4b-8d97-8864052eb96f

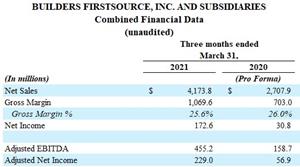

BUILDERS FIRSTSOURCE, INC. AND SUBSIDIARIES

Combined Financial Data

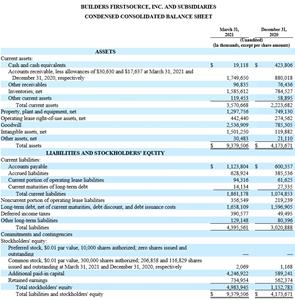

BUILDERS FIRSTSOURCE, INC. AND SUBSIDIARIES

Condensed Consolidated Statement of Operations

BUILDERS FIRSTSOURCE, INC. AND SUBSIDIARIES

Condensed Consolidated Balance Sheet

BUILDERS FIRSTSOURCE, INC. AND SUBSIDIARIES

Condensed Consolidated Statement of Cash Flows

BUILDERS FIRSTSOURCE, INC. AND SUBSIDIARIES

Reconciliation of Adjusted Non-GAAP Financial Measures to their GAAP Equivalents

BUILDERS FIRSTSOURCE, INC. AND SUBSIDIARIES

Financial Data

BUILDERS FIRSTSOURCE, INC. AND SUBSIDIARIES

Interest Reconciliation

BUILDERS FIRSTSOURCE, INC. AND SUBSIDIARIES

Sales by Product Category

BUILDERS FIRSTSOURCE, INC. AND SUBSIDIARIES

Combined Financial Data